Financial Planning to help you love living your life, your way

Life Planning and Financial Services

Some people have spent years climbing up their ladder only to find that it’s been leaning against the wrong wall. Time must be given to find what you want out of life. Only then can financial planning give you real value. Our advisors are here to help you to understand where you are now, ask the right questions to find out where you want to be and help discover what you need. Our mission is to give you the tools and financial means to help your future-self live a life you love.

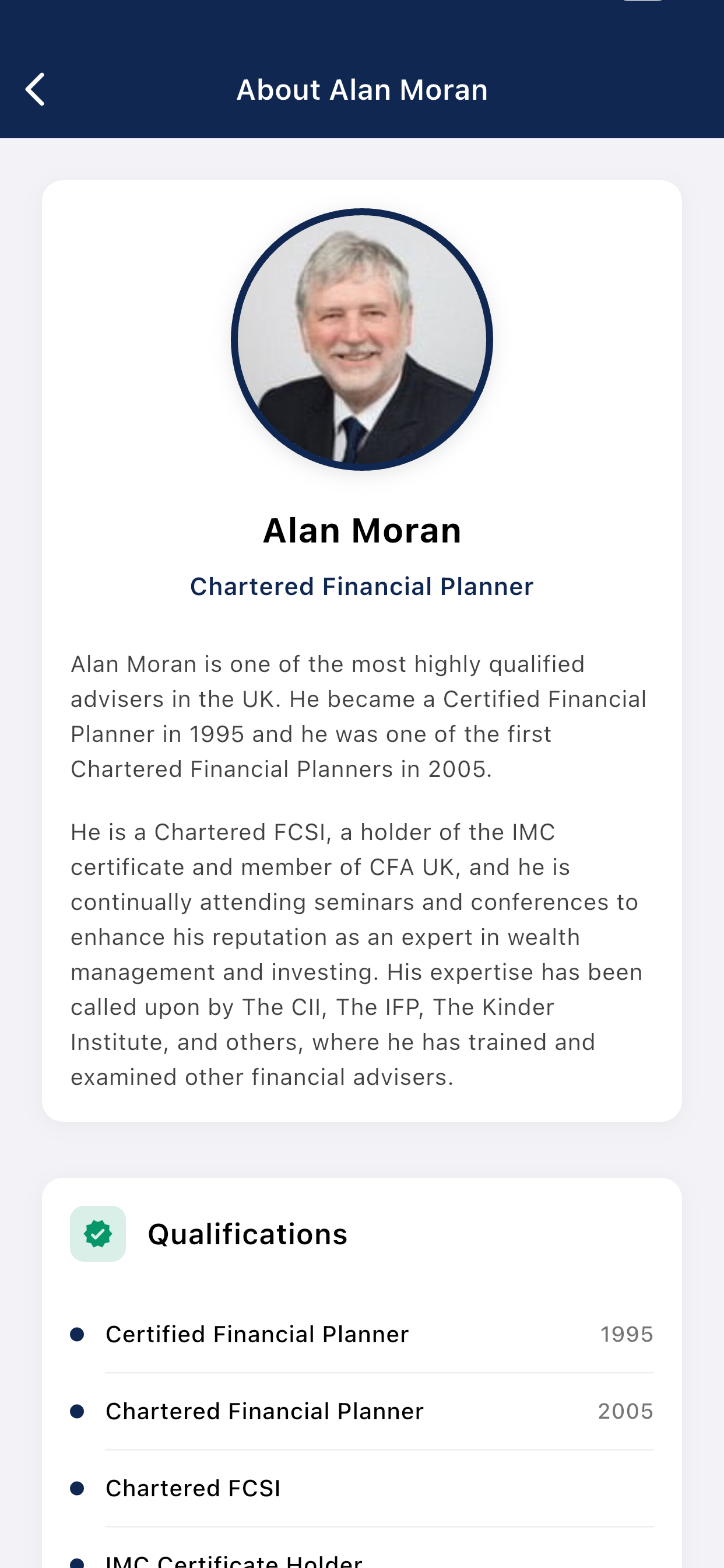

About Alan Moran

Alan Moran is one of the most highly qualified advisers in the UK. He became a Certified Financial Planner in 1995 and he was one of the first Chartered Financial Planners in 2005.

He is a Chartered FCSI, a holder of the IMC certificate and member of CFA UK, and he is continually attending seminars and conferences to enhance his reputation as an expert in wealth management and investing. His expertise has been called upon by The CII, The IFP, The Kinder Institute, and others, where he has trained and examined other financial advisers.

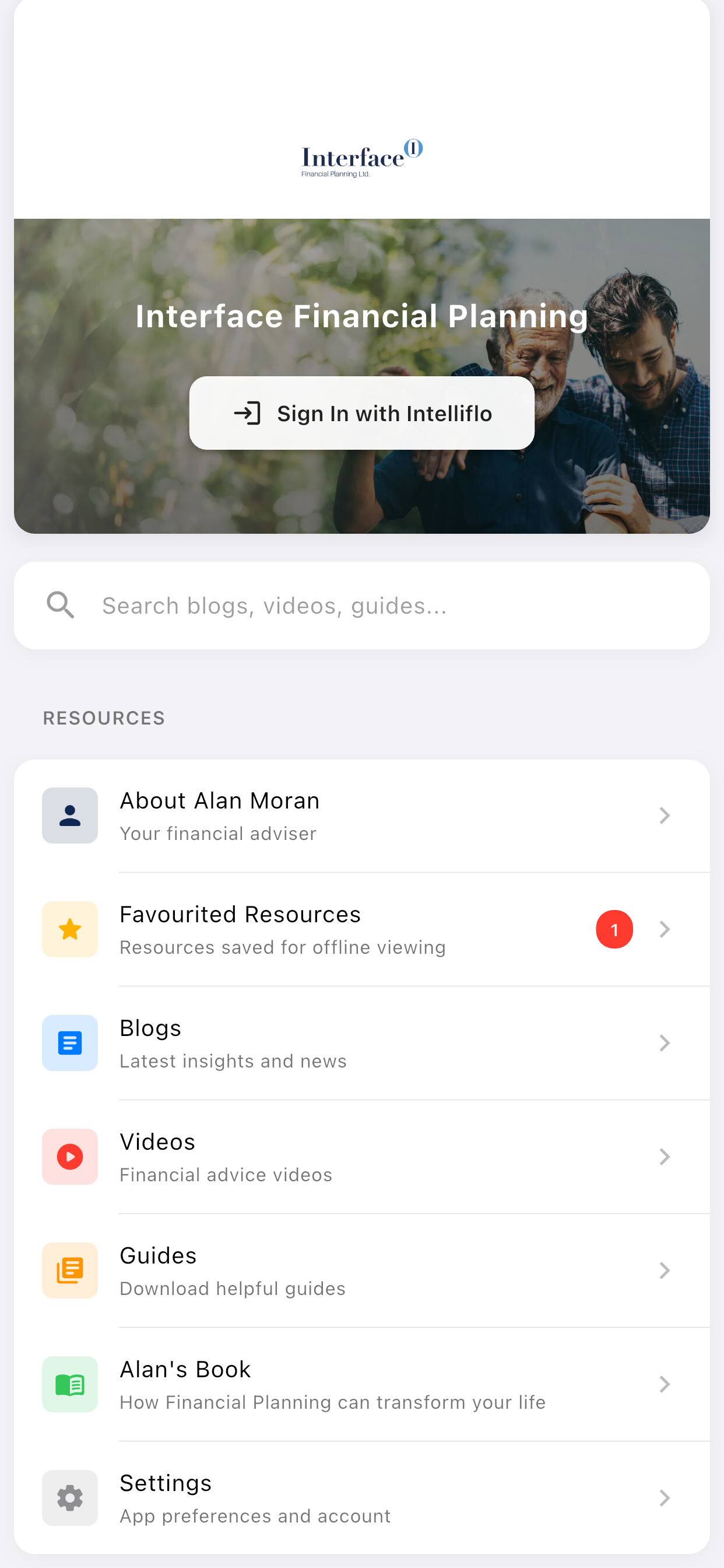

Our App

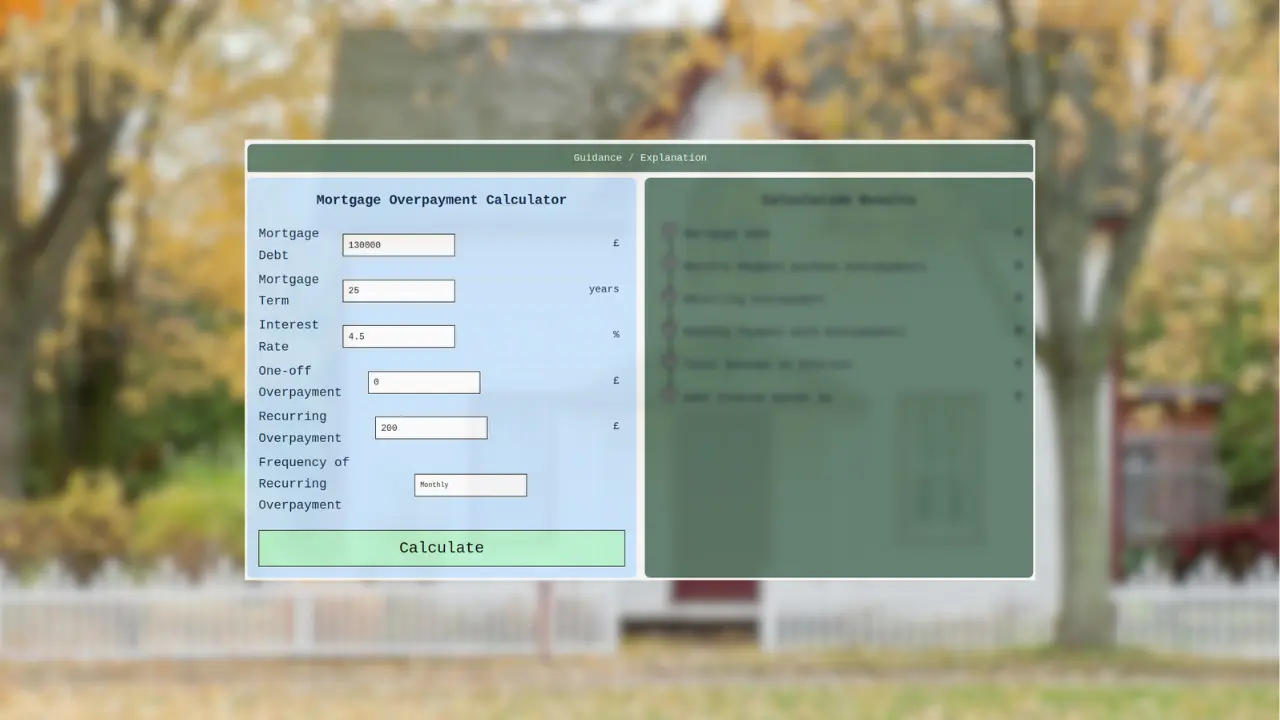

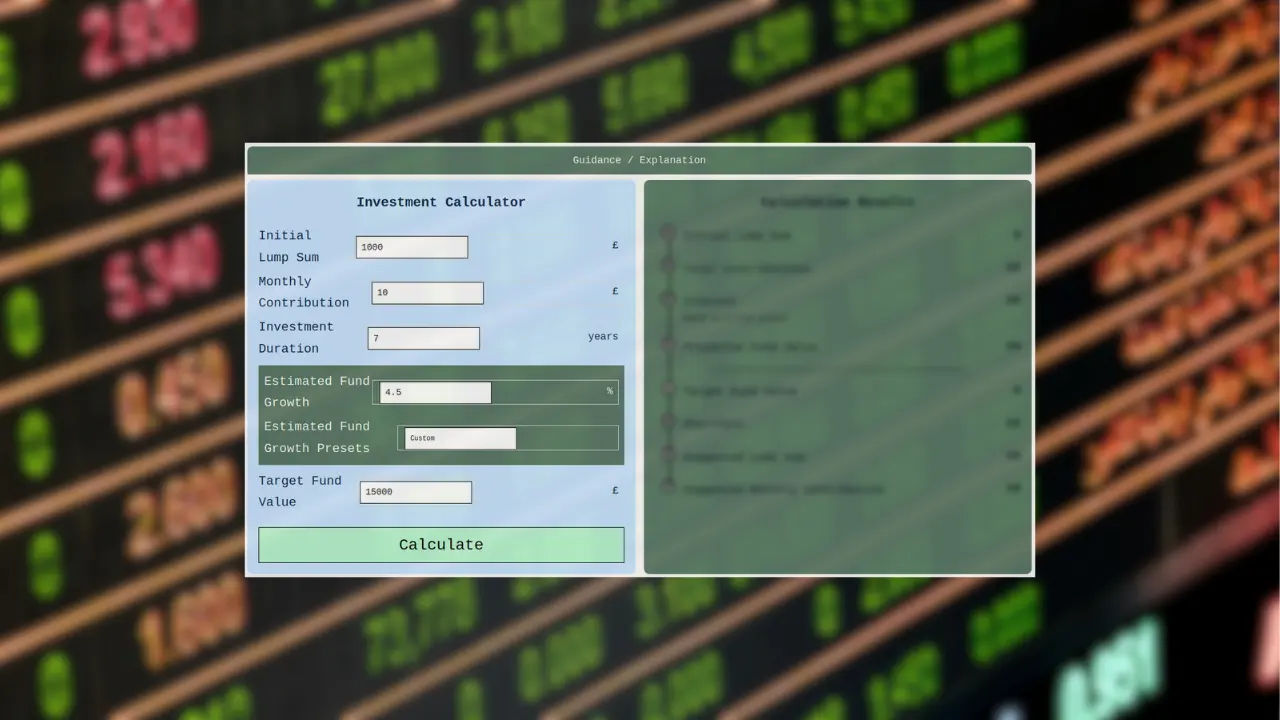

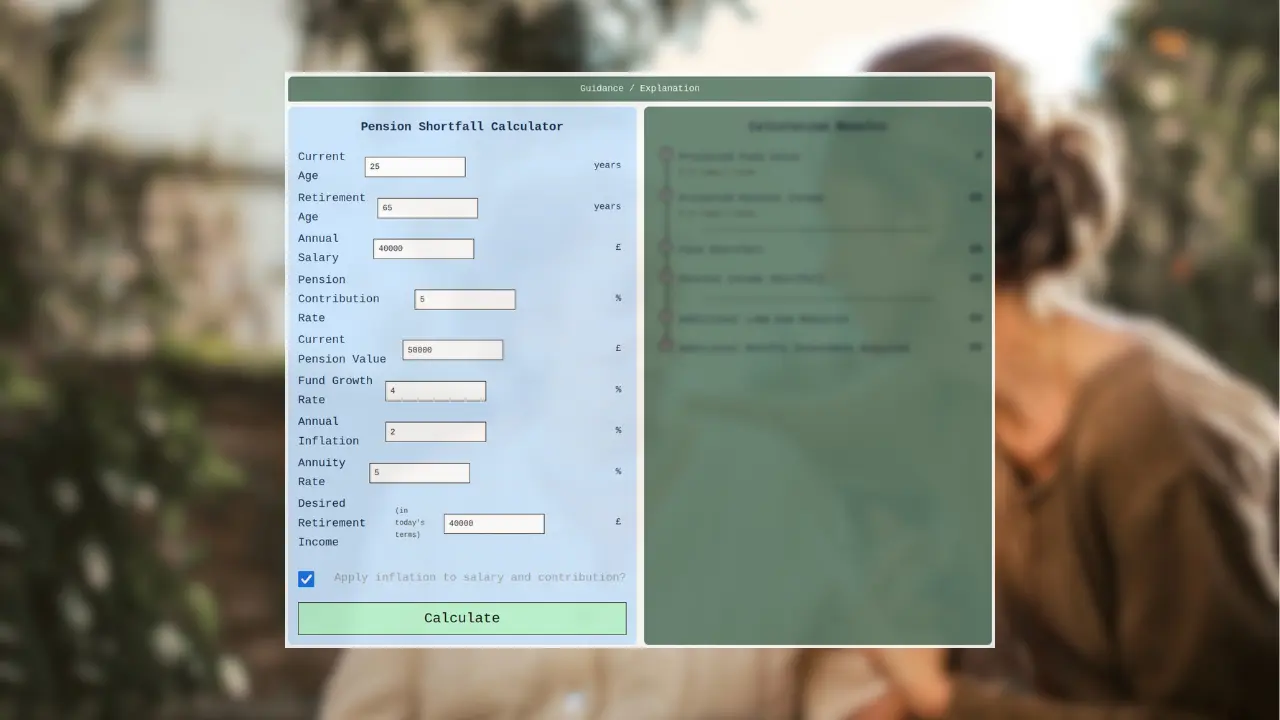

Powerful features to help you manage and understand your finances

Interface Financial Planning

Your financial life, in your pocket. Access your investments, use powerful calculators, and stay informed with guides, videos and articles – all in one place.

Existing clients can securely view their portfolio and assets through our Intelliflo integration. Everyone can access our suite of financial calculators and educational resources.

How Financial Planning Can Transform Your Life

Alan Moran

Our Process

We use a three step planning process.

1 Life Planning

Our primary service is Life Planning – understanding your goals and what you want to achieve financially over 5-30 years. We explore what drives you and what you want your money to do. Without these answers, no financial decisions can be made. We’ll identify costs of your desired lifestyle and future goals.

2 Financial Planning

We analyse all existing arrangements and project their future value using sophisticated software to show your complete financial future. We examine income, expenditure, and catastrophe scenarios, then model “what if” situations to achieve your goals. This is when clients understand what’s needed and money starts making sense.

3 Independent Financial Advice

Only if your financial plan requires products do we research the entire market using sophisticated software to compare performance, volatility, and asset allocation. We provide rigorous analysis and detailed recommendations suited to your specific objectives. This reverses typical product-first approaches. We believe advisers have no right to sell without this comprehensive process.

Our Guides

Informative, educational guides..

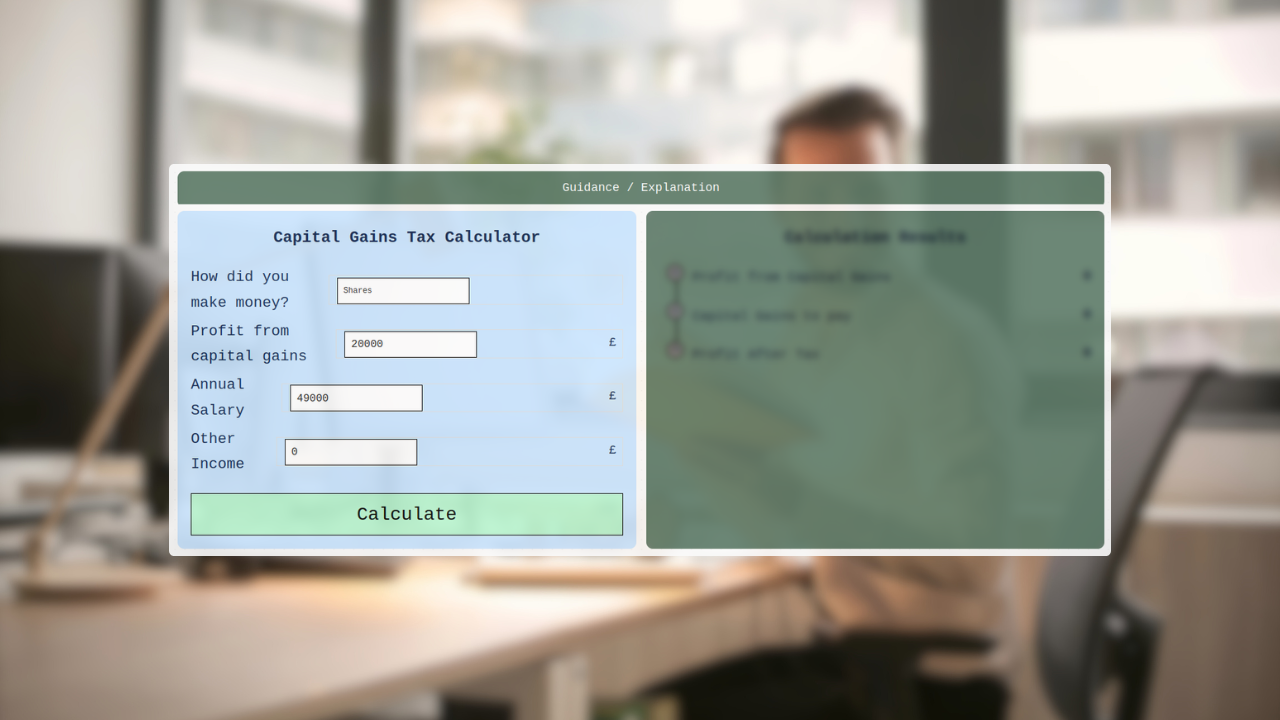

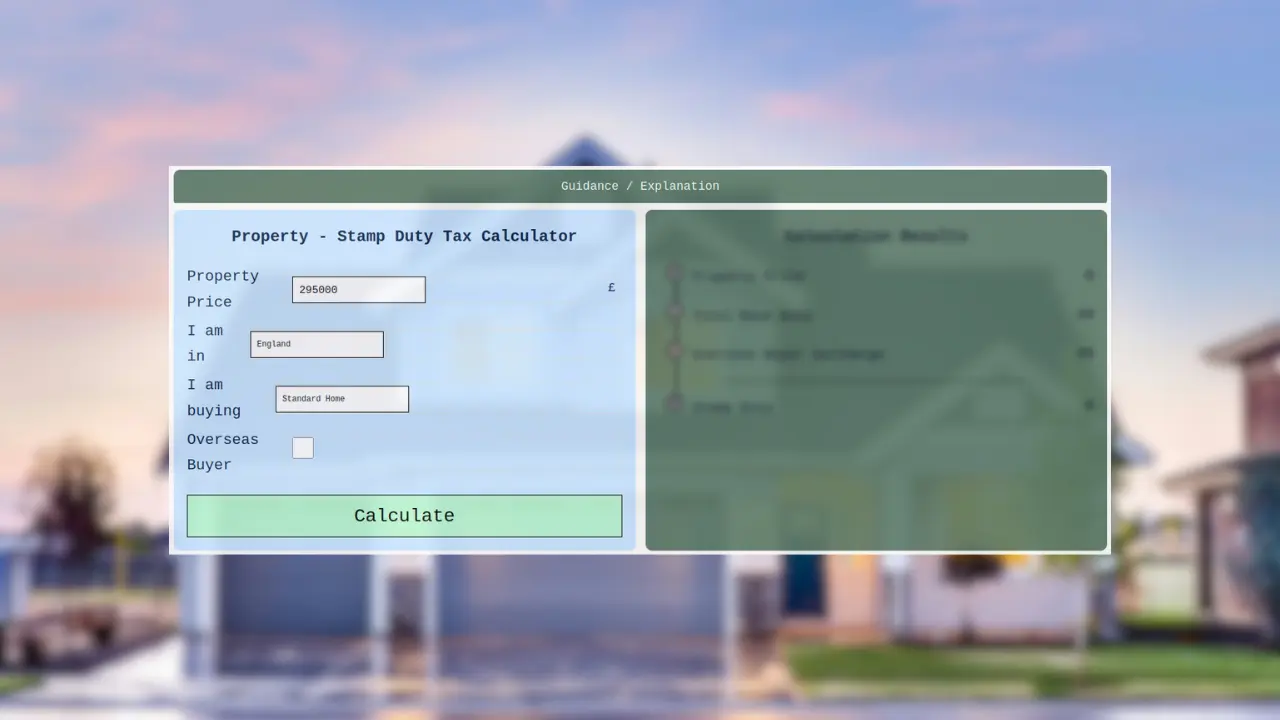

Leave the calculations to us

Equity and tax planning can be overwhelming. Our tools do the heavy lifting so you can focus on what matters.