Steven’s Pension Plans

Financial Advice for Retirement Planning

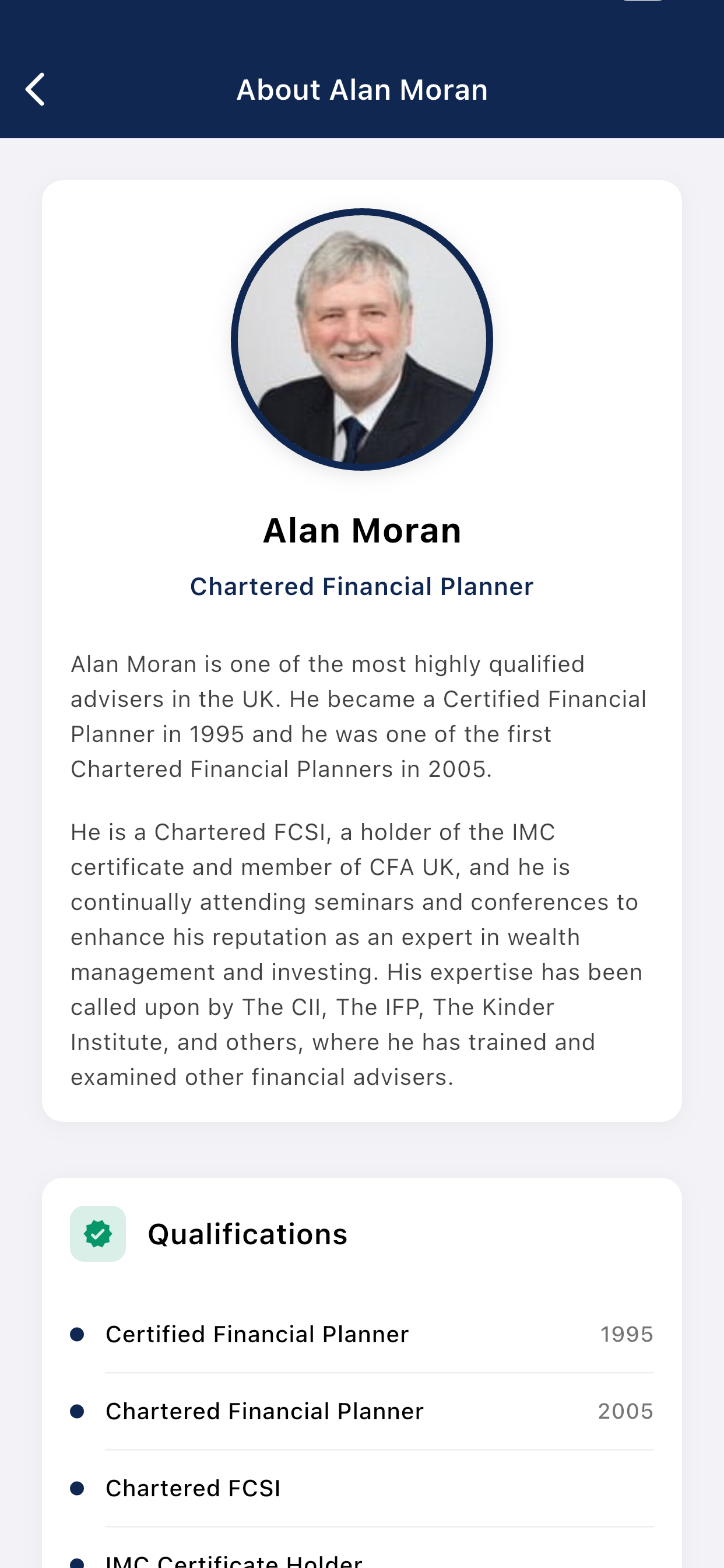

“I first met Steve with his wife Meryl in October 1996 and I was immediately struck by his warmth and generosity. In my early years of helping clients with their financial affairs I made the decision to choose clients by whether they were nice people and Steve won five stars in that category. We share the same values of compassion and contribution and we always enjoy sharing our experiences. Over the last twenty- two years it has been a pleasure and a privilege to be Steve’s financial adviser and our friendship has become equally as (if not more important than) the financial advice – it is always a joy to be in touch.” -Alan Moran, Interface Financial Planning

“Alan, was immediately empathetic, encouraging and, above all, practical and straightforward”

Steven – Cirencester

I was approaching an enforced (although welcome) early retirement at 55 and my plan was to continue working on a self-employed basis. This raised all sorts of issues; most notably how to manage such an arrangement, what to do about pensions, lump sum payments and tax requirements. My own circumstances were complex. I was in a second marriage, had two adult daughters, grandchildren of my own and a teenage step daughter. There were still some complications connected with my first marriage responsibilities, my wife and I had just discovered there was an issue around under-payment of our mortgage loan… and we hadn’t written our wills.

I realised that I had been operating both my general and particularly financial affairs reactively for far too long and it was time I behaved like a grown up. So I started to think about how I might achieve some sort of practical stasis. Alan, was immediately empathetic, encouraging and, above all, practical and straightforward. I hadn’t consciously taken financial advice before, but came to realise that the various salesmen who had sold me policies and pension upgrades were not motivated in the same way a ‘proper’ financial adviser was (or should be). Consequently, I had taken on commitments that weren’t necessarily in my best interests. Alan is genuinely interested in my circumstances, and owns a readiness to go beyond what I had imagined would be the boundaries of the role.

We have had many stimulating philosophical, sociological and political conversations over time, all of which have been relevant to his life- planning approach. Whilst Alan has cleverly created a very efficient support team around himself, it still comes down to him providing the key interface, both literally and metaphorically! For someone like me who is generally cautious and risk averse, Alan worked hard initially to identify my life goals and consider being a little more ambitious in pursuing what seemed, at first, to be counterintuitive approaches. I am now well into my retirement proper and have no real financial worries. I am relaxed in the knowledge that, not only will I be comfortably off, but that I will probably be in a position to be the ‘Bank of Grandpa’ to my burgeoning group of grand and probably great grandchildren.

Steven

Cirencester